Delhi CM Rekha Gupta approves Rs 1,200 crore for salaries of DTC employees, pensioners, enhance urban mobility

Delhi Chief Minister Rekha Gupta has approved a grant of Rs 1,200 crore for the Delhi Transport Corporation (DTC), in a significant relief to many employees and pensioners, and introducing technology-driven initiatives to decongest the capital’s roads.

The single crushing problem American cattle ranchers wish Trump would fix instead

President Donald Trump’s beef import plan aims to cut prices, but cattle ranchers say it misses what’s crushing them most — the power of meat packers. “Meat packers have created a system where they win no matter what — at the cost of everyone else,” said Will Harris, a fourth-generation cattleman and owner of White Oak Pastures in Bluffton, Georgia. Harris, who plans to hand off the operation to his children, said his farm handles every step of production, from raising cattle to processing and selling beef, giving him a clear view of how prices are set. AMERICA’S SMALLEST CATTLE HERD IN 70 YEARS MEANS REBUILDING WILL TAKE YEARS AND BEEF PRICES COULD STAY HIGH At the center of that pricing power sit the “Big Four” — Tyson, JBS, Cargill and National Beef — anchoring the U.S. beef supply chain from pasture to plate. Together, the packing titans process about 85% of the grain-fattened cattle that become steaks, roasts and other supermarket cuts. “The U.S. beef market is so highly concentrated that a small number of dominant packers control processing, distribution and pricing. This allows them to pay ranchers less for cattle while charging consumers more at the store. When cheap imported beef enters the system, it allows packers to increase their margins,” Harris told Fox News Digital. It’s a concern echoed deep into cattle country. Texas cattle rancher Cole Bolton said he sees the same problem in the Lone Star State. IN TEXAS CATTLE COUNTRY, ONE RANCHER WELCOMES TRUMP’S FOCUS ON DECADES OF THIN MARGINS “What the real issue is, is the price differential between the big four packers and what they’re paying us for the product,” said Bolton, the owner of K&C Cattle Company. Those margins, Bolton said, have been squeezed for decades. “Ranchers have dealt with such thin margins of profitability for the last 20 years.” While ranchers like Bolton and Harris say Trump’s temporary expansion of U.S. beef imports from Argentina may help ease prices in the short term, both warn it is no substitute for rebuilding domestic production. “Imports should be a bridge, not a long-term replacement,” Harris said. “We must rebuild the American cattle herd, protect American farmers and ensure transparency, so consumers understand where their beef comes from. Long-term affordability depends on a healthy, resilient domestic cattle industry — not permanent dependence on foreign beef.” Years of drought, high feed costs and an aging ranching population have thinned herds, leaving the U.S. cattle supply at its lowest level in more than 70 years. “I think it’s going to take a while to fix this crisis that we’re in with the cattle shortage. My message to consumers is simple: Folks, be patient. We’ve got to build back our herds,” Bolton told Fox News Digital. He noted that the cattle industry, over the last five years, has weathered one setback after another, from market turmoil to extreme weather conditions.

Super Bowl Sunday: Here are some of the political, social commercials you can expect during the big game

One of the most anticipated parts of Super Bowl Sunday is not necessarily the game, it’s the commercials throughout the big game. Hundreds-of-millions in advertising revenue will hit the airwaves Sunday night, but not everyone is trying to get you to buy something. Viewers can expect to see anti-hate ads, ads that focus on Christianity, and ads supporting political candidates that want viewers to buy in to their political views. A 30-second spot during this year’s game costs from $8 million to $10 million. SUPER BOWL SUNDAY MENUS ARE CHANGING; PARTY HOSTS SERVE UP SURPRISES THIS YEAR A pro-Trump nonprofit, Invest America, bought time during the pre-game broadcast to promote the president’s new tax-free “Trump Accounts,” which were established in the GOP’s One Big Beautiful Bill Act as tax-free savings accounts for American children, many of which will be seeded with $1,000 from the federal government. Children will be able to use the funds from these accounts for things like education expenses, or down payments on a new home. The ad will feature children talking about the importance of investing. “It’s gonna get a lot of attention. All your viewers, watch the Super Bowl right after the national anthem, we’re gonna have a big rollout,” Treasury Secretary Scott Bessent said last month on a local Midwest radio station. New England Patriots’ owner Robert Kraft’s nonprofit the Blue Square Alliance, which was formerly called the Foundation to Combat Antisemitism, will have another advertisement this year against antisemitism. His group has been buying ad spots at the Super Bowl since at least 2022 to stand up against hate directed at the Jewish community. Last year, the group’s ad featured appearances from celebrities like Snoop Dogg and Tom Brady. This year’s advertisement will focus on antisemitism among younger people, particularly those in schools. The ad encourages supporters to post an image of a blank blue square, resembling a sticky note, to illustrate standing up against Jewish hate. A Republican candidate for governor in Michigan, Perry Johnson, has been sponsoring ads running from several days before the game up until Sunday evening, according to the candidate’s campaign. The advertisement, which will only be seen in select Michigan TV markets, urges folks to turn the channel during the Bad Bunny halftime show and tune into the halftime show being produced by the late Charlie Kirk’s Turning Point USA (TPUSA). Bad Bunny’s selection by the NFL has created a political stir, with critics calling him anti-American. ANTI-TRUMP PERFORMERS LITTER SUPER BOWL LX IN CALIFORNIA “Join me in changing the channel during halftime to Turning Point’s ‘All American Halftime Show’ for some great American entertainment during America’s game,” Johnson’s ad encourages viewers. Viewers in Maine and Texas will see advertising from the political campaigns of incumbent Sen. Susan Collins, R-Maine, and Democrat challenger to U.S. Sen. John Cornyn, R-Texas, James Talarico, who is a state senator in Texas. Collins’ campaign ad was purchased on her behalf by One Nation, a nonprofit tied to the Senate Leadership Fund, the top super PAC for Senate Republicans. They are coughing up about $5.5 million for a several-months-long ad buy planned to focus on the Maine viewing market. According to the local Portland Press, her 30-second ad features stock clips of firefighters while discussing Collins’ efforts to pass legislation banning “forever chemicals” linked to cancer. “Call Sen. Collins and thank her for protecting Maine’s first responders,” a narrator concludes the advertisement, according to a version reportedly shared on YouTube. Talarico, who reportedly spent more than $100,000 from his campaign to air his ad, according to local reports, shared his advertisement on social media. Talarico focuses on slamming billionaires and ethics, particularly related to campaign finance and congressional stock trading. “Millionaires don’t just influence politicians, they own them. That’s why I don’t take corporate PAC money. That’s why I fought to cap campaign contributions,” Talarico says in his ad. “In the Senate I’ll ban billionaires from making unlimited, secret donations. I’ll stop members of Congress from trading stocks. And I’ll raise taxes on those at the top to fund tax cuts for the rest of us.” The pro-Christian ad campaign that launched in 2022 with help from the family behind Hobby Lobby has been criticized over the years as its commercials have become a talking point following past Super Bowls. The campaign’s ads have typically focused on social conflicts and it plans to unveil yet another ad during this year’s game. This year’s message touches on wealth, image, insecurity, digital addiction, fame and other pressures in life, rather than social conflicts, similar to ads they have done during past Super Bowls, according to pre-releases of the ad ahead of the game.

LA city councilwoman previously backed by DSA running for mayor in primary challenge to former ally Bass

Los Angeles City Council member Nithya Raman entered the race for mayor Saturday, launching a last-minute challenge against incumbent Karen Bass just hours before the filing deadline. The move by Raman, a progressive representing the city’s 4th District, signals the potential for a high-stakes June primary against a close political ally, though she has not yet qualified for the ballot. To qualify, candidates must either pay a $300 filing fee and submit at least 500 valid signatures, or submit 1,000 valid signatures without a fee, according to the Los Angeles City Clerk’s office. Nominating petitions are due by March 4. SPENCER PRATT SAYS A-LISTERS PRIVATELY CHEER HIS CRITICISM OF CALIFORNIA LEADERSHIP, FEAR CAREER FALLOUT “I love this city so much and I think it needs a fighter. And I think I’ve demonstrated that I can be that fighter,” Raman said at a press conference, according to NBCLA. “And I hope the residents of Los Angeles will see that and cast their votes for me.” “This is a city of extraordinary possibility, extraordinary,” she added. “But possibility only matters if our leadership is accountable for delivering it, and I’m ready to lead this city with seriousness, with accountability, urgency and ambition that is equal to this moment.” A total of 40 candidates have filed declarations of intention to run for Los Angeles mayor, including TV personality Spencer Pratt and housing advocate Rae Chen Huang, according to a list from the city clerk’s office. SPENCER PRATT ENTERS LA MAYOR RACE, ACCUSES CURRENT LEADERSHIP OF ‘CRIMINAL NEGLIGENCE’ OVER FIRE RESPONSE Raman was previously endorsed by the Democratic Socialists of America Los Angeles chapter during her 2020 campaign, but the group voted to censure her in 2024 over her acceptance of an endorsement from Democrats for Israel–Los Angeles and disagreements related to the war in Gaza. NBCLA reported that Raman informed Bass of her intent to run against her before the announcement. “The last thing Los Angeles needs is a politician who opposed cleaning up homeless encampments and efforts to make our city safer,” said Douglas Herman, Bass’ campaign advisor, in response to Raman’s campaign launch. “Mayor Bass will continue changing L.A. by building on her track record delivering L.A.‘s first sustained decrease in street homelessness, a 60-year low in homicides, and the most aggressive agenda our city has ever seen to make our city more affordable.”

West Virginia worked with ICE — 650 arrests later, officials say Minnesota-style ‘chaos’ is a choice

A relatively brief, but lucrative ICE surge into West Virginia netted roughly 650 illegal immigrant arrests recently — a two-week, statewide operation officials say unfolded with little disruption and now stands as a counterpoint to the turmoil surrounding similar enforcement efforts in Minnesota. From Jan. 5 through Jan. 19, federal agents fanned out across the Mountain State — at times working with local law enforcement — targeting illegal immigrants with criminal histories or prior deportation orders, DHS officials told Fox News Digital. Officials involved contrast the West Virginia operation with recent tensions in Minnesota, where ICE-related enforcement actions have sparked sustained protests, surveillance of federal agents and confrontations with law enforcement. “I think the most important thing to notice here is that West Virginia and similarly situated states… have made it very, very easy for criminal illegal aliens to be picked up and processed by ICE,” West Virginia Attorney General JB McCuskey told Fox News Digital in an exclusive interview. MANY OF AMERICA’S SAFEST CITIES ARE IN JURISDICTIONS THAT COOPERATE WITH ICE Some of the operations even reached the state’s bluer-tinged Eastern Panhandle, the fast-growing exurb of Washington, D.C., where officials say cooperation, not confrontation, defined the response. There, Jefferson County Sheriff Thomas Hansen confirmed a two-week operation with ICE in his jurisdiction, which includes Charles Town, Harpers Ferry and Summit Point. “The (JCSO) was impressed with the professionalism and work ethic of the agents and how well they interacted with the citizens and local law enforcement officers,” Hansen said in a statement obtained by Fox News Digital. McCuskey said the lack of disruption in West Virginia reflected a cooperative approach that he argued prevented the kind of disorder seen elsewhere. “When you contrast that with places like Minnesota, where you have Keith Ellison — who’s obviously embroiled in a massive fraud scandal involving Somali immigrants, et cetera, what you see is riots and violence,” he said. McCuskey suggested the West Virginia mission shows Minnesota’s leadership can no longer blame federal law for its approach, noting that all states still operate under the same immigration statutes that have remained intact since the Obama administration. TRUMP’S IMMIGRATION VICTORY IN A MINNESOTA COURT IS A WIN FOR ALL LAW-ABIDING CITIZENS “All God-fearing Americans believe in immigration. We believe that the promise of this country should be available to those who want to come to America the right way, follow our laws, and become great parts of this incredible quilt that is the American experience,” McCuskey said. “And if your first act as a hopeful new American is to break our laws, that trust has been broken.” McCuskey also accused Minnesota’s leadership of failing on parallel issues, calling Ellison “dalliant” in confronting social services fraud. “My office [oversees] the same things,” he said, noting West Virginia also has a high proportion of residents on entitlements but lacks the level of fraud he says plagues Minnesota. Just across the Potomac River from ICE’s Martinsburg sting, Maryland Democrats lambasted ICE’s presence in Washington County. ICE REVEALS ‘WORST OF THE WORST’ ARRESTS IN JUST ONE DAY AFTER ROUNDING UP ‘THUGS’ CONVICTED OF VILE CRIMES McCuskey called that a “representation of the generalized idiocy of most of the Democrats in Congress, who have sat on their hands for the last 25 years and done nothing about the very immigration laws that they’re very angry about being enforced.” Ellison, by contrast, showered protesters with praise at a recent public appearance, calling ICE’s operations a “federal invasion” and telling those assembled in the Twin Cities that he “wanted you to know that I was here with you, fighting with you, standing with you. Keep fighting, stand up strong, don’t back down.” Fox News Digital reached out to Ellison and Gov. Tim Walz for comment, but neither office responded. DHS officials, however, said they expect states that cooperate with ICE to see similar success to West Virginia. Assistant Secretary Tricia McLaughlin said “work[ing] together can make America safe again.” DHS told Fox News Digital of similarly low-profile ICE operations in Alabama, including activity near Birmingham that netted a violent illegal immigrant accused of stabbing a federal agent, along with enforcement actions in other cities reported by local media. Alabama Gov. Kay Ivey and Sen. Tommy Tuberville told Fox News Digital they will continue to welcome federal agents in the Yellowhammer State, with Tuberville, a candidate for governor, quipping that one mayor who has pledged to protect illegal immigrants “won’t like me very much” if he succeeds Ivey. Those arrested in the West Virginia sweep included Mexican national Enrique Vergara, convicted of assault with a weapon; Guatemalan national Isaias Santos, convicted of several violent charges; Julian Garza, charged with auto theft; Brayan Canelis-Giron, charged with domestic violence and gun offenses; and Dennis Paz-Vallecillo, convicted of child neglect. Not every Mountaineer leader was on board, however, as West Virginia Democratic Party Chair Mike Pushkin — a state delegate from Kanawha County — told Fox News Digital people “have to be honest about what’s really going on here.” FROM PROTEST TO FELONY: THE LINES MINNESOTA ANTI-ICE AGITATORS MAY BE CROSSING “The difference between what you’re seeing in Minnesota and what’s happening in West Virginia isn’t complicated — it’s courage,” Pushkin said, crediting Minnesota leaders with standing up to President Donald Trump “trampl[ing] due process and ignor[ing] the Constitution.” “Republican leaders here won’t even clear their throats — and trying to compare the size and scope of the Minnesota operation to what happened here is just silly. That’s like comparing a house fire to a burnt piece of toast and pretending they’re the same emergency,” he said. Pushkin cited a Clinton-appointed judge’s order that some of the detainees be released, including two men picked up on the West Virginia Turnpike. “In the court’s words, there wasn’t ‘a shred of evidence to justify the government’s position’ — that should be the headline. That should alarm anyone who cares about freedom or the rule of law,” Pushkin said. “Minnesota leaders pushed back. West Virginia’s Republican

India-US Trade Deal: Farmers’ Unions call for nationwide protests on February 12

Farmer groups, including SKM and AIKS, have opposed the India-US interim trade deal, warning that it could harm Indian agriculture. They announced nationwide protests, accused the government of favouring US corporations, and pledged support to a February 12 general strike.

Who are Jaspreet Singh, Kamal Kishor Yadav? Two senior IAS officers suspended by Punjab government, here’s why

Two senior IAS officers Jaspreet Singh and Kamal Kishor Yadav have been suspended by Punjab government with immediate effect, as per provisions of Rule 3(1) of the All India Services (Discipline and Appeal) Rules, 1969.

Two cases of tuberculosis detected at El Paso ICE facility

Eighteen cases of COVID-19 were also identified. U.S. Rep. Veronica Escobar on Friday visited the 5,000-bed tent facility on the Fort Bliss Army base and said she saw many “chronic issues.”

Federal appeals court upholds Trump mass detention policy for illegal immigrants

A federal appeals court on Friday upheld the Trump administration’s mass detention policy, allowing illegal immigrants to be detained without bond. The 5th U.S. Circuit Court of Appeals ruled 2-1 that the Department of Homeland Security (DHS) can lawfully deny bond hearings to immigrants arrested nationwide under the Constitution and federal immigration law. Attorney General Pam Bondi reacted to the ruling, saying the Department of Justice (DOJ) “secured yet another crucial legal victory” in support of President Donald Trump’s immigration agenda. “The Fifth Circuit just held illegal aliens can rightfully be detained without bond — a significant blow against activist judges who have been undermining our efforts to make America safe again at every turn,” she wrote on X. “Thank you to Ben Hayes who argued this case, Brett Shumate and the @DOJCivil Division. We will continue vindicating President Trump’s law and order agenda in courtrooms across the country.” BOASBERG ORDERS TRUMP TO BRING BACK CECOT MIGRANT CLASS DEPORTED IN MARCH Circuit judge Edith H. Jones wrote in the majority opinion that “unadmitted aliens apprehended anywhere in the United States are ineligible for release on bond, regardless of how long they have resided inside the United States.” Many illegal immigrants who were not detained at the border previously had the opportunity to request a bond hearing as their cases progressed, and those without a criminal history who were not deemed flight risks were often granted bond. “That prior Administrations decided to use less than their full enforcement authority under” the law “does not mean they lacked the authority to do more,” Jones wrote. SUPREME COURT ALLOWS TRUMP ICE RAIDS TO RESUME IN CALIFORNIA Writing in dissent, Circuit Judge Dana M. Douglas said that the members of Congress who passed the Immigration and Nationality Act roughly 30 years ago “would be surprised to learn it had also required the detention without bond of two million people.” Douglas noted that some of the people detained are “the spouses, mothers, fathers, and grandparents of American citizens.” The ruling stems from two separate cases filed last year against the Trump administration, both involving Mexican nationals who had lived in the U.S. for more than a decade and were not considered flight risks, according to their attorneys. Although they did not have criminal records, both were jailed for months last year before a lower court in Texas granted them bond last October. The Associated Press contributed to this report.

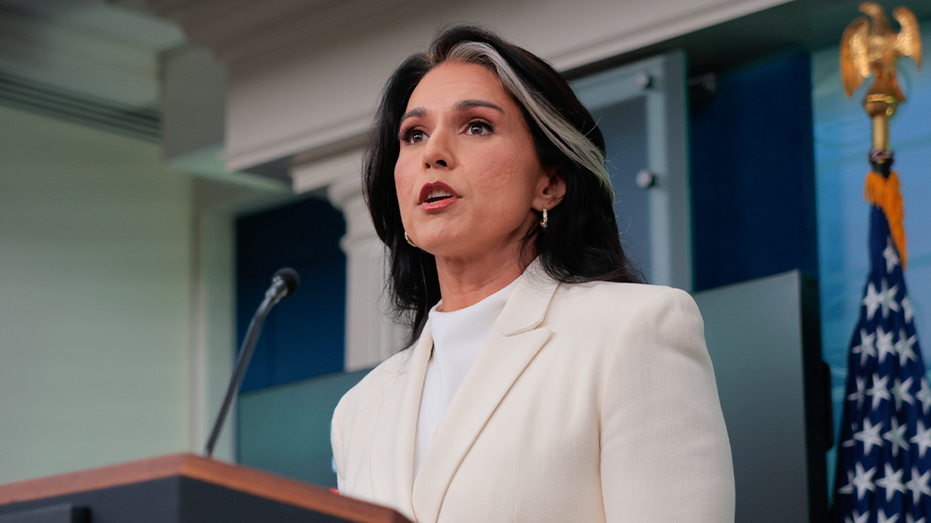

Tulsi Gabbard denies wrongdoing over delayed whistleblower complaint referral to Congress members: ‘Baseless’

Director of National Intelligence Tulsi Gabbard denied any wrongdoing on Saturday as Democrats question why a whistleblower complaint filed against her last May took nearly a year before it was referred to Congress. “[Virginia Democrat] Senator Mark Warner and his friends in the Propaganda Media have repeatedly lied to the American people that I or the ODNI ‘hid’ a whistleblower complaint in a safe for eight months,” Gabbard wrote in a lengthy X post on Saturday. “This is a blatant lie.” She continued, “I am not now, nor have I ever been, in possession or control of the Whistleblower’s complaint, so I obviously could not have ‘hidden’ it in a safe. Biden-era IC Inspector General Tamara Johnson was in possession of and responsible for securing the complaint for months.” The highly classified complaint by a U.S. intelligence official alleging wrongdoing on the part of Gabbard was filed eight months ago with the intelligence community’s watchdog office and was first reported on by the Wall Street Journal. EXCLUSIVE: GABBARD OUTLINES ELECTION SECURITY ASSESSMENT, PRESENCE AT FULTON COUNTY SEARCH The complaint has been locked in a safe since its filing, according to the Journal, with one U.S. official telling the newspaper that the disclosure of its contents could cause “grave damage to national security.” The whistleblower’s lawyer has accused Gabbard’s office of slow-walking the complaint, which her office has denied, calling it “baseless and politically motivated.” Meanwhile, Democrats are also questioning why it took her office so long to hand the complaint over to Congress. TRUMP CONFIRMS WHAT TULSI GABBARD WAS DOING AT GEORGIA ELECTION CENTER “The law is clear,” Warner, the senior Democrat on the Senate Intelligence Committee, said Thursday, according to NPR, adding that the complaint was required to be sent to Congress within 21 days of its filing. “I think it was an effort to try to bury this whistleblower complaint.” Neither the contents of the complaint nor the allegations against Gabbard have been revealed. Gabbard wrote on Saturday that the first time she saw the complaint was “when I had to review it to provide guidance on how it should be securely shared with Congress.” TRUMP CLAIMS DNI TULSI GABBARD WAS AT GEORGIA ELECTION HUB SEARCH BECAUSE AG PAM BONDI WANTED HER THERE “As Vice Chair of the Senate Intelligence Committee, Senator Warner knows very well that whistleblower complaints that contain highly classified and compartmented intelligence—even if they contain baseless allegations like this one—must be secured in a safe, which the Biden-era Inspector General Tamara Johnson did and her successor, Inspector General Chris Fox, continued to do,” she continued. “After IC Inspector General Fox hand-delivered the complaint to the Gang of 8, the complaint was returned to a safe where it remains, consistent with any information of such sensitivity.” She claimed that either “Warner knows these facts and is intentionally lying to the American people, or he doesn’t have a clue how these things work and is therefore not qualified to be in the U.S. Senate.” Gabbard further wrote that “When a complaint is not found to be credible, there is no timeline under the law for the provision of security guidance. The ‘21 day’ requirement that Senator Warner alleges I did not comply with, only applies when a complaint is determined by the Inspector General to be both urgent AND apparently credible. That was NOT the case here.” An inspector general representative said that it had determined some of the allegations in the complaint against Gabbard weren’t credible, while it hasn’t made a determination on others, according to the Journal. Gabbard said she was made aware that she needed to provide security guidance on the complaint by IC Inspector General Chris Fox on Dec. 4, “which he detailed in his letter to Congress.” Afterward, she said she “took immediate action to provide the security guidance to the Intelligence Community Inspector General, who then shared the complaint and referenced intelligence with relevant members of Congress last week.” In closing her post, Gabbard once again accused Warner of spreading “lies and baseless accusations over the months for political gain,” which she said “undermines our national security and is a disservice to the American people and the Intelligence Community.” Warner’s office told Fox News Digital Gabbard’s post was an “inaccurate attack that’s entirely on brand for someone who has already and repeatedly proven she’s unqualified to serve as DNI.” Republicans on the House and Senate intelligence committees have backed up Gabbard, with Sen. Tom Cotton, R-Ark., writing on X on Thursday: “I have reviewed this ‘whistleblower’ complaint and the inspector general handling of it. I agree with both inspectors general who have evaluated the matter: the complaint is not credible and the inspectors general and the DNI took the necessary steps to ensure the material has handled and transmitted appropriately in accordance with law.” He addded, “To be frank, it seems like just another effort by the president’s critics in and out of government to undermine policies that they don’t like; it’s definitely not credible allegations of waste, fraud, or abuse.” Gabbard’s office did not immediately respond to Fox News Digital’s request for comment.